Vat rules for cross-border supplies of goods

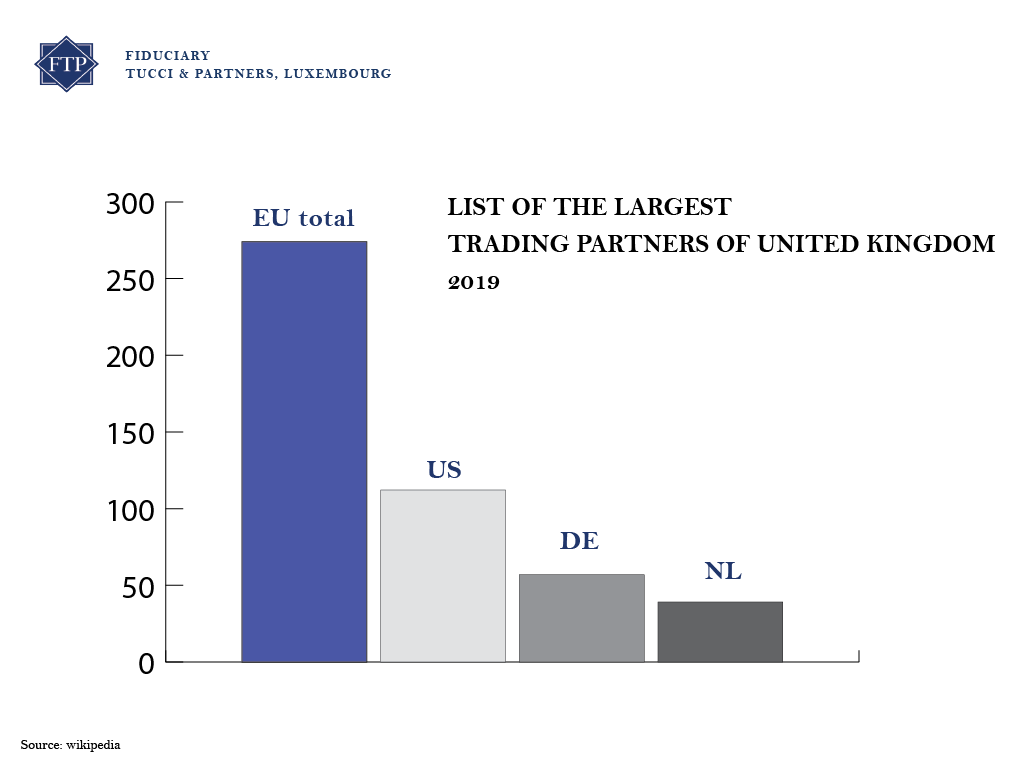

Since 1 February 2020, the United Kingdom has withdrawn from the European Union and has become a non – member of EU with a transition period ending on 31 December 2020.

As of the end of the transition period, the EU rules for cross-border supplies and movements between Member States will no longer apply in the relations between Member States and the United Kingdom, e.g. no intra-EU supplies and acquisitions of goods; no distance sales regime for goods to and from the United Kingdom).

Instead, supplies and movements of goods between the EU and the United Kingdom will be subject to the VAT rules on imports and exports.

This implies that goods which are brought into the VAT territory of the EU from the United Kingdom or are to be taken out of that territory for dispatch or transport to the United Kingdom, will be subject to customs supervision and may be subject to customs controls

VAT refunds by Member States to taxable persons established outside the EU are subject to the following conditions:

- The request must be submitted directly to the Member State from which the refund is requested

- The VAT refund may be subject to a reciprocity condition (meaning that the refund is only permitted if VAT refund is also granted by the third country or territory to taxable persons established in the Member State concerned

- Each Member State may require the taxable person established in a third country or territory to designate a tax representative in order to obtain the VAT refund. Subject to the Withdrawal Agreement, as of the end of the transition period these rules apply to refunds by Member States to taxable persons established in the United Kingdom.

Fiduciary Tucci & Partners Service Spotlight:

Sustainable Success Through Accounting

For companies focused on executing and improving their core product or service, accounting can be a nuisance. Not only does expert bookkeeping and reporting prevent future crises, but it can actually improve your finances.

After analyzing your financial situation, we build a sustainable strategy to optimize your business. Our accounting services include bookkeeping, reporting, balance-sheet forecasts, financial viability studies and budget preparation.

Companies also come to Fiduciary Tucci & Partners for license applications, business plan creation and overall company setup. We do not just help an organization make sense of its financial situation, we turn it into a source of strength.

Share your goals with us & ask how we can help you get there. Questions about trends, regulations & requirements? Curious about Luxembourg? Fiduciary Tucci & Partners can help answer your queries & find solutions.